Ecosystem

RWA assets

At Scenium, Real World Assets (RWAs) are digital tokens that represent physical and traditional financial assets, such as real estate, stocks, and bonds. Tokenization of RWAs offers a transformative opportunity within the blockchain industry, potentially capturing market values in the hundreds of trillions of dollars. By converting these assets into digital tokens, Scenium effectively bridges the gap between the traditional financial world and the emerging digital economy.

Real-World Asset (RWA) tokenization is the process of converting ownership or participation in physical assets—such as real estate, commodities, bonds, or even fine art—into digital tokens on a blockchain. This concept allows for the creation of a bridge between traditional finance and decentralized finance (DeFi), providing access to new liquidity streams, enhancing transparency, and reducing friction in asset transactions.

By tokenizing RWAs, tangible assets can be fractionalized, enabling smaller, more diverse investments from a broader range of participants. For example, instead of purchasing an entire real estate property, an investor could buy a fractional ownership share represented by tokens, which can then be traded on blockchain-based platforms.

Key benefits of RWA tokenization include:

- Increased Liquidity: Tokenization enables assets that were traditionally illiquid, like real estate or private equity, to be traded on secondary markets, unlocking liquidity that would otherwise remain untapped.

- Accessibility: Tokenization democratizes access to investments by lowering barriers to entry, allowing investors to participate in asset classes that were previously limited to institutional or high-net-worth individuals.

- Transparency: Transactions on a blockchain are immutable and transparent, providing a clear audit trail and improving trust among market participants.

- Efficiency: Blockchain-based tokenization can streamline processes like settlement, clearing, and compliance, reducing the need for intermediaries and driving down transaction costs.

- Fractional Ownership: The ability to tokenize assets allows investors to own smaller shares of high-value assets, diversifying portfolios and reducing exposure to any single investment.

In practice, RWA tokenization is transforming the way people think about asset ownership and investment, bringing the efficiencies of blockchain technology to the tangible, real-world economy. As blockchain adoption continues to grow, tokenized RWAs have the potential to reshape financial markets, making them more inclusive, liquid, and efficient.

At Scenium, we are dedicated to fostering the development of sustainable economies through a robust and inclusive ecosystem. Our native utility token, “SCNM,” serves as the epicenter of this ecosystem, acting as both a direct communication channel and a means of participation for token holders in the ongoing innovations and governance of the platform. This structure not only empowers investors but also promotes a more dynamic and responsive investment environment.

The future of Scenium lies in building an ecosystem where diverse economic agents—ranging from retail investors to institutional players—can coexist and thrive. By using tokenization as the foundation, we enable a seamless and efficient flow of capital across various asset classes. Our platform facilitates the mobilization of funds in a manner that is both transparent and accessible, ensuring that all participants can benefit from sophisticated investment opportunities traditionally reserved for high-net-worth individuals and institutional investors.

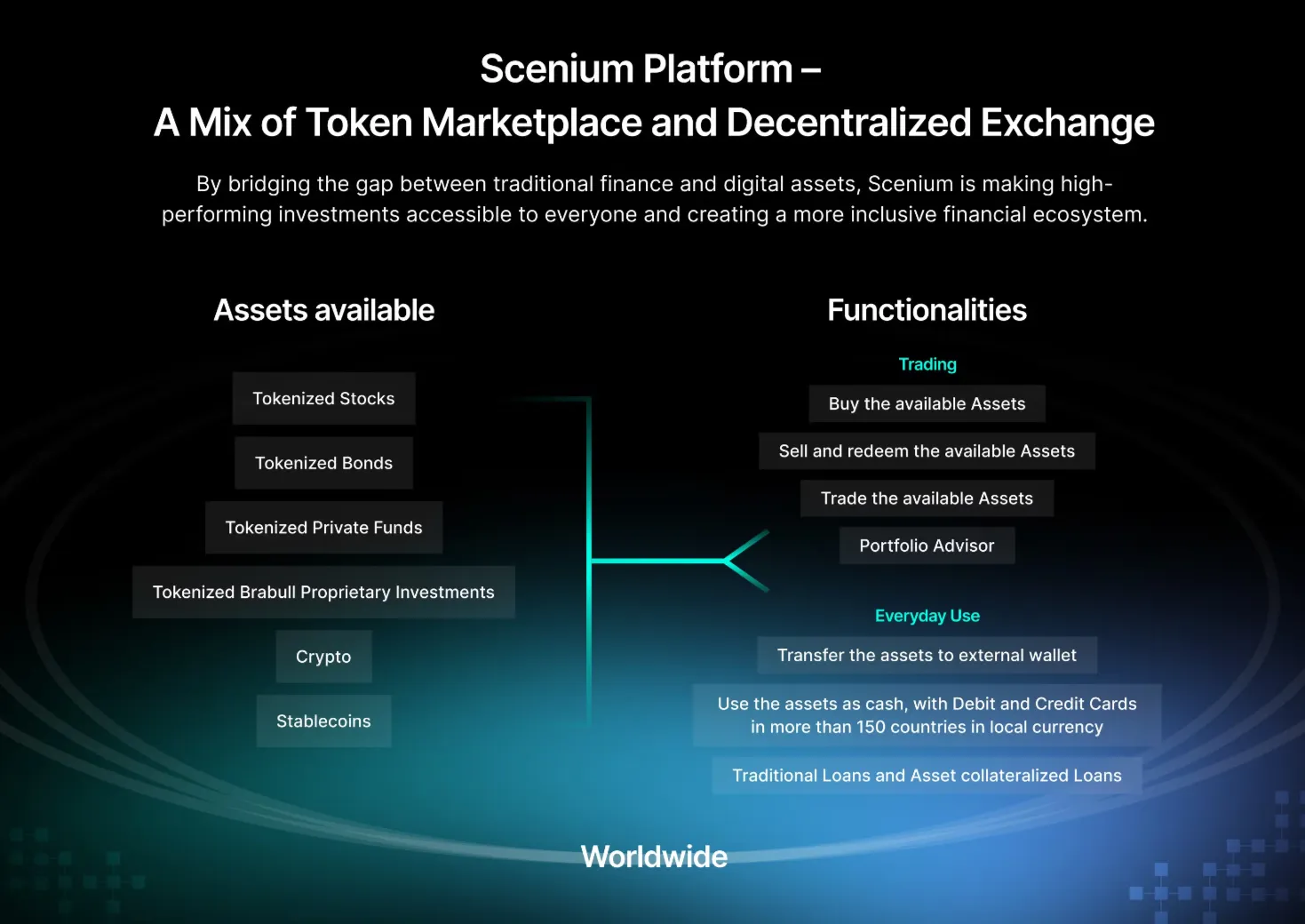

Our commitment to democratizing access for investors is central to our mission. Scenium is designed to be accessible to everyone, breaking down barriers that have historically limited investment opportunities for the general public. While tokenized stocks are a unique and powerful feature of our platform, it’s crucial to emphasise that Scenium offers much more. We recognize that regular investors often lack access to high-performing assets like private equity and differentiated stock funds (such as mutual funds and hedge funds), which have traditionally outperformed the market. This limitation not only restricts opportunities for investors but also hinders fund managers from reaching a broader audience.

Scenium aims to address these challenges by providing retail investors with access to these high-return assets. Through our platform, we offer a wide range of investment options, including tokenized private equity, venture capital, real estate, and more. In addition, our ecosystem will feature a suite of financial services, such as a debit card, crypto trading, loans, and private funds, all designed to enhance liquidity and provide greater flexibility for investors.

We are committed to leveraging cutting-edge technology and implementing rigorous due diligence processes to ensure that our investment offerings are both profitable and secure. By providing transparent, high-quality investments with enhanced liquidity options, Scenium bridges the gap in investment accessibility, enabling a broader audience to achieve their financial goals.

In essence, our efforts at Scenium are focused on transforming the investment landscape, making it more inclusive, transparent, and dynamic. We believe that by democratizing access to sophisticated investment opportunities, we can help create a more equitable financial system that benefits all participants.