Problems and Solutions

Expanding Access to Investment: Scenium’s Token Marketplace

With the blockchain universe offering numerous benefits to investors, Scenium has created a token marketplace to expand the range of possibilities. Through our experience and research methods, we have observed that investors outside of the US seeking to invest in U.S. stocks and REITs face significant challenges, one of the largest being the withholding tax on dividends.

For most countries, this tax takes 30% of the income, while countries with a tax treaty face a reduced rate of 15%. This substantial difference greatly impacts the total return of portfolios, particularly for those invested in income-generating assets.

A second issue, particularly for retail investors, is the difficulty associated with opening accounts to trade these assets, navigating the platforms, and managing the liquidation process.

While we consider this to be a lesser issue compared to the withholding tax, it remains significant as it can greatly impact the usability and accessibility of the platform.

Retail investors often face barriers such as complex registration procedures, unfamiliar trading interfaces, lengthy settlement processes, which can deter participation and limit their investment opportunities and high currency exchange fees.

Broader Tokenization Challenges

In another perspective, for investors within and outside the US we have other types of issues. Most platforms utilizing tokenization to expand investment options are still primarily restricted to accredited investors and are often limited to real estate projects. These platforms typically offer fundraising for specific real estate properties or developments, thereby excluding a broader range of investment opportunities.

Regular investors currently lack access to funds reserved for high-net-worth individuals, such as private real estate, private equity and diversified stock funds (including mutual funds and hedge funds) that frequently outperform the market.

This restriction significantly limits the investment opportunities available to everyday investors, preventing them from participating in potentially higher-yielding asset classes.

Our solution benefits not only investors, but fund managers in niche markets. Funds not yet featured on mainstream platforms lack direct access to the general public, limiting their fundraising potential. If these funds were available on a platform where they could advertise and showcase their returns, they would likely have a greater chance of attracting investments.

This increased visibility and access would enable fund managers to reach a broader audience, enhancing their ability to raise capital and grow their funds.

Democratizing Private Investment Access

In our perspective we see a tremendous opportunity in these asset classes for investors around the world who currently face significant challenges in accessing investments efficiently, or even at all, particularly in the realms of private equity and other private funds. Many investors are excluded from these high-potential markets due to barriers such as high entry requirements, lack of transparency, and limited liquidity options.

Our goal is to be a pioneer in democratizing access to these investments for retail investors globally. By doing so, we aim to capture market share in this niche and establish ourselves as a leading reference in curating and developing alternative investment opportunities.

Our platform will focus on delivering to investors unique access to high-quality investments and enhanced liquidity options. We intend to leverage cutting-edge technology and robust due diligence processes to ensure that our investment offerings are not only profitable but also secure and transparent.

By providing retail investors with opportunities traditionally reserved for institutional players and high-net-worth individuals, we will bridge the gap in investment accessibility and help a broader audience achieve their financial goals.

Through our efforts, we aspire to transform the investment landscape, making it more inclusive and dynamic.

ACCESS TO PRIVATE INVESTMENTS

Retail investors face significant challenges when trying to access high-value investment opportunities. The complexity of opening accounts, navigating platforms, and managing the liquidation process often deters participation. Furthermore, many lucrative investment opportunities, such as private equity, private real estate and diversified stock funds, remain accessible only to high-net-worth individuals, leaving regular investors excluded. This restricts their ability to benefit from potentially higher-yielding asset classes.

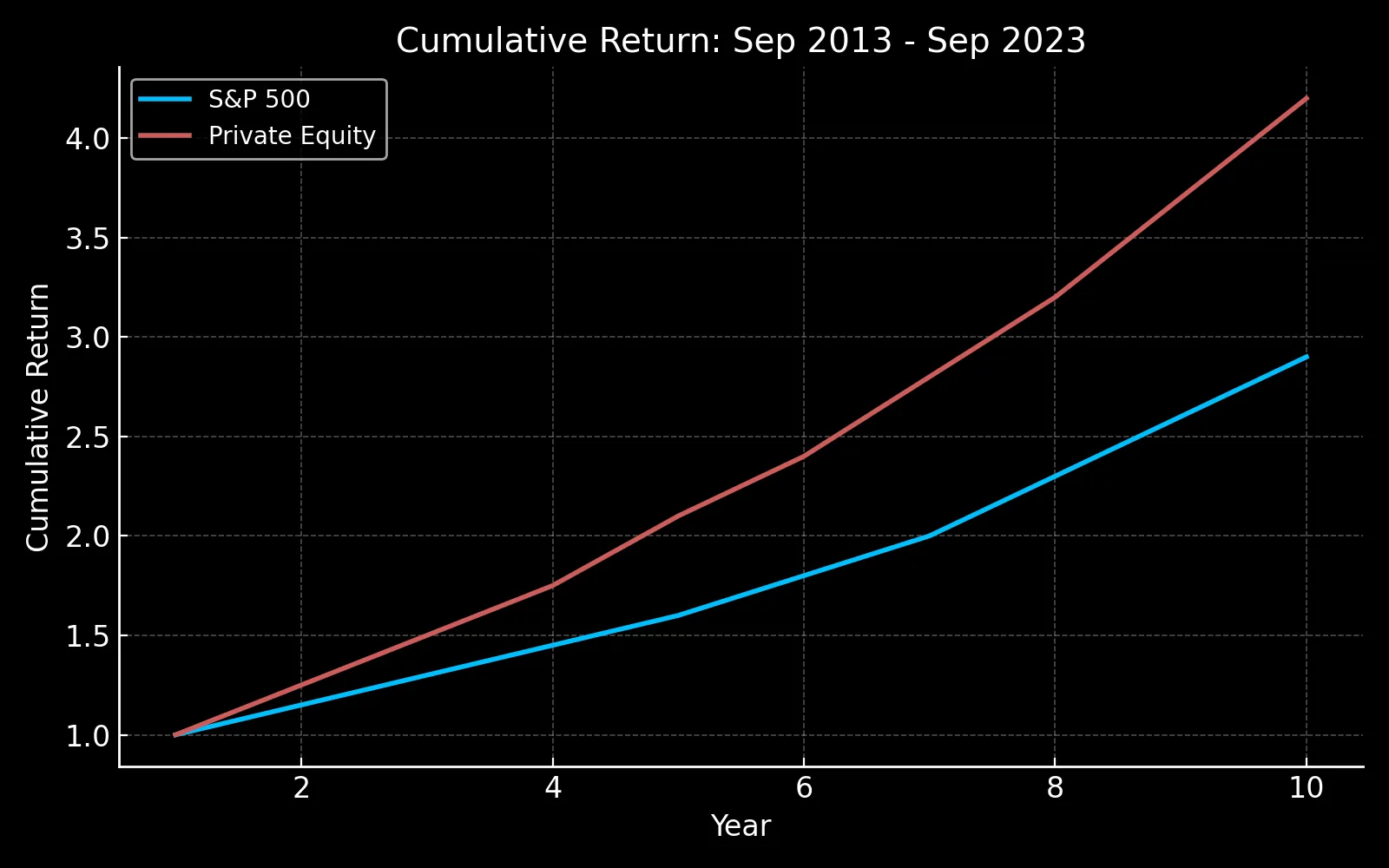

PRIVATE EQUITY – ANALYSIS

The private equity industry significantly outperforms the S&P across the 3, 5, and 10-year windows ending in September 2023.

Investors seeking superior returns over extended periods have found a lucrative avenue in the private equity sector. Recent data reveals that the private equity industry has outpaced the S&P500 index comprehensively across multiple timeframes.

This consistent outperformance underscores the attractiveness and potential profitability of private equity investments, positioning them as a preferred choice for investors with long-term wealth generation objectives.

Source: Preqin – Return for $1 invested

However, regular investors still have no way to access funds reserved for high-net-worth individuals and other asset classes such as private equity and differentiated stock funds (mutual, hedge funds) that outperform the market.

This restriction harms fund managers and investors, as funds that are not yet on mainstream platforms have no direct access to the general public.

With a platform where they can advertise and show their returns, these funds would have an increased chance of raising capital, and investors a lot more good options to choose from and increase their returns.

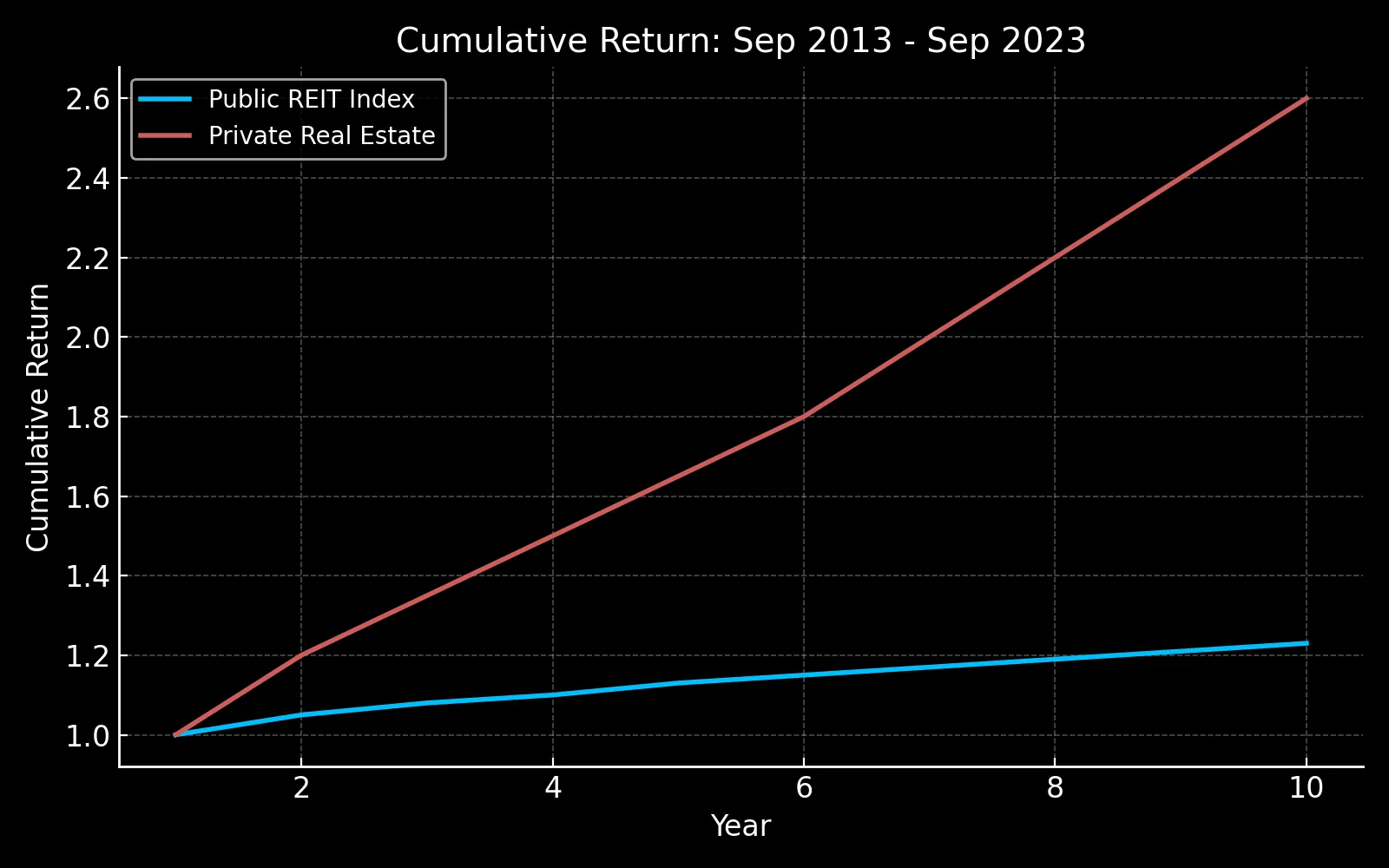

PRIVATE REAL ESTATE FUNDS – ANALYSIS

Following the same concept, we conducted an analysis from 2013 to 2023, comparing the cumulative returns of public REIT indices versus private REIT indices. Our findings indicated that, over a long-term horizon (20 years or more), public REITs consistently outperformed the S&P 500. However, this trend did not hold over the more recent 3, 5, and 10-year periods ending on September 2023.

The private real estate funds markets offer a wide array of funds that often outperform public REITs with less volatility.

Source: Preqin – Return for $1 invested

We want to emphasize the inequity that retail investors are not given the opportunity to invest in these types of investments. Private equity, private real estate, and other more profitable investment classes, such as funds of funds and venture funds, deliver results that exceed the stock market with less volatility.

Looking at the chart and considering the overall context, what this graphic shows is that the publicly accessible FTSE Real Estate Total Equity Index available to retail investors underperforms compared to the cumulative returns of private real estate. This indicates that, within the same segment, private real estate investments, which are not accessible to everyone, yield higher returns.

For example, when comparing returns accessible to everyone over the 2013-2023 period, the difference is evident. The cumulative returns of private real estate, not available to all investors, show a noticeable uptrend, highlighting the superior performance of private investments in this sector.